Talk to mortgage brokers.

Many first-time home buyers don’t take the time to get prequalified. They also often don’t take the time to shop around to find the best mortgage for their particular situation. It’s important to ask plenty of questions and make sure you understand the home loan process completely.

Be ready to move.

This is especially true in markets with a low inventory of homes for sale. It’s very common for home buyers to miss out on the first home they wish to purchase because they don’t act quickly enough. By the time they’ve made their decision, they may find that someone else has already purchased the house.

Find a trusted partner.

It’s absolutely vital that you find a real estate professional who understands your goals and who is ready and able to guide you through the home buying process.

Make a good offer.

Remember that your offer is very unlikely to be the only one on the table. Do what you can to ensure it’s appealing to a seller.

Factor maintenance and repair costs into your buying budget.

Even brand-new homes will require some work. Don’t leave yourself short and let your home deteriorate.

Think ahead.

It’s easy to get wrapped up in your present needs, but you should also think about reselling the home before you buy. The average first-time buyer expects to stay in a home for around 10 years, according to the National Association of REALTORS®’ 2013 Profile of Home Buyers and Sellers.

Develop your home/neighborhood wish list.

Prioritize these items from most important to least.

Select where you want to live.

Compile a list of three or four neighborhoods you’d like to live in, taking into account nearby schools, recreational facilities, area expansion plans, and safety.

Other blog entries

• Doggie Ice Cream Bar: Cones For Bones (05/16/2024)• Dillinger is Gone, Welcome Mosaic Brewing (05/11/2024)

• Grandma Angelina’s Pizzas In Tucson: Barro’s Pizza (05/06/2024)

• Green Acres Estates, Tucson, Arizona (04/16/2024)

• Looking For Relief? Chill Acupuncture And Wellness (04/15/2024)

• Classy Menu, Classy Service: Blue Willow Restaurant (04/09/2024)

• An Antique Dive Bar: The Buffet Bar (03/07/2024)

• Orangewood Estates - A Lovely, Older, NW Tucson Neighborhood (03/05/2024)

• Neighborhood Saloon: Nancy’s Boondocks (03/02/2024)

• Food Court Without The Mall: American Eat Co (02/15/2024)

» Blog archive

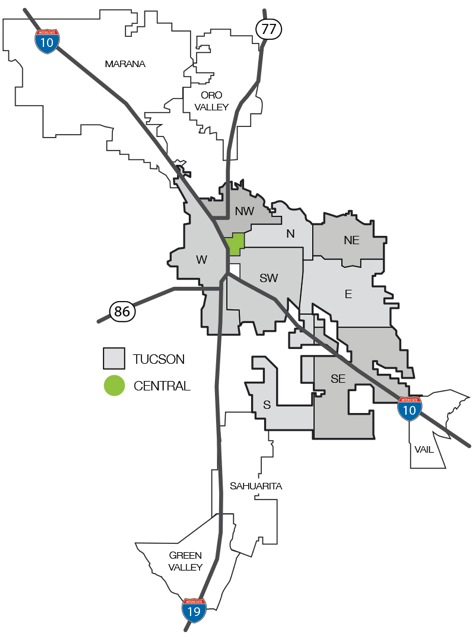

Click on Map to Start Your Tucson Home Search