Why Homebuyers Need to Act Now

“Delayed purchases will only result in higher monthly mortgage payments as prices and rates rise,” Smoke writes. Realtor.com® is forecasting that affordability may decline as much as 10 percent over the year.

The Federal Reserve continues to remind the financial markets that it plans to raise its target federal funds rate this year, which will cause mortgage rates to rise. Many economists are predicting 30 year fixed-rate mortgages to average near 5% by the end of the end of the year.

For now, mortgage rates are near historical lows for homebuyers and home owners who can take advantage. Freddie Mac reported that the 30-year fixed-rate mortgage averaged 3.66 percent (last year at this time it averaged 4.32 percent), and 15-year fixed-rate mortgages averaged 2.98 percent (a year ago, it averaged 3.40 percent).

“Right now, the Fed is using the word ‘patient’ to describe its approach to picking the time to raise the target rate,” Smoke notes. “However, when the Fed ‘loses patience,’ rates will go up at least 20 to 40 basis points in anticipation of the target rate officially going up. So, buyers beware: The clock on these low mortgage rates may be ticking.”

Daily Real Estate News

Other blog entries

• Doggie Ice Cream Bar: Cones For Bones (05/16/2024)• Dillinger is Gone, Welcome Mosaic Brewing (05/11/2024)

• Grandma Angelina’s Pizzas In Tucson: Barro’s Pizza (05/06/2024)

• Green Acres Estates, Tucson, Arizona (04/16/2024)

• Looking For Relief? Chill Acupuncture And Wellness (04/15/2024)

• Classy Menu, Classy Service: Blue Willow Restaurant (04/09/2024)

• An Antique Dive Bar: The Buffet Bar (03/07/2024)

• Orangewood Estates - A Lovely, Older, NW Tucson Neighborhood (03/05/2024)

• Neighborhood Saloon: Nancy’s Boondocks (03/02/2024)

• Food Court Without The Mall: American Eat Co (02/15/2024)

» Blog archive

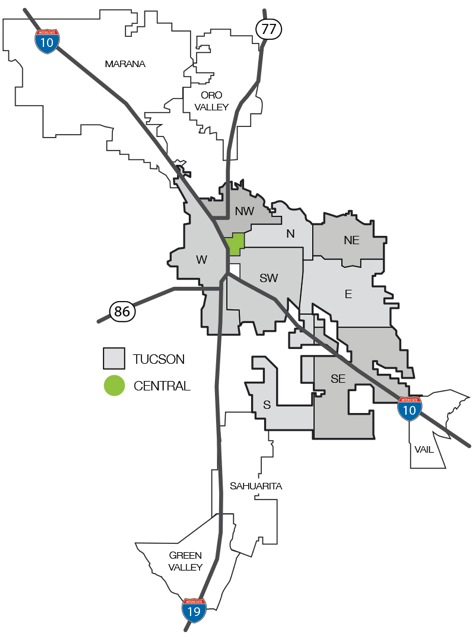

Click on Map to Start Your Tucson Home Search