Keep your emotions in check and your eyes on the goal, and you’ll pay less when purchasing a home.

Buying a home can be emotional, but negotiating the price shouldn’t be. The key to saving money when purchasing a home is sticking to a plan during the turbulence of high-stakes negotiations. {Gregory Richman, Realtor} can represent you, guide you and offer you advice, but you are the one who must make the final decision during each round of offers and counter offers.

Here are six tips for negotiating the best price on a home.

1. Get Prequalified for a Mortgage

Getting prequalified for a mortgage proves to sellers that you’re serious about buying and capable of affording their home. That will push you to the head of the pack when sellers choose among offers; they’ll go with buyers who are a sure financial bet, not those whose financing could flop.

2. Ask Questions

Ask {Gregory Richman, Realtor} for information to help you understand the sellers’ financial position and motivation. Are they facing foreclosure or a short sale? Have they already purchased a home or relocated, which may make them eager to accept a lower price to avoid paying two mortgages? Has the home been on the market for a long time, or was it just listed? Have there been other offers? If so, why did they fall through? The more signs that sellers are eager to sell, the lower your offer can reasonably go.

3. Work Back From a Final Price to Determine Your Initial Offer

Know in advance the most you’re willing to pay, and with {Gregory Richman, Realtor} work back from that number to determine your initial offer, which can set the tone for the entire negotiation. A too-low bid may offend sellers emotionally invested in the sales price; a too-high bid may lead you to spend more than necessary to close the sale.

Work with {Gregory Richman, Realtor} to evaluate the sellers’ motivation and comparable home sales to arrive at an initial offer that engages the sellers yet keeps money in your wallet.

4. Avoid Contingencies

Sellers favor offers that leave little to chance. Keep your bid free of complicated contingencies, such as making the purchase conditional on the sale of your current home. Do keep contingencies for mortgage approval, home inspection, and environmental checks typical in your area, like radon.

5. Remain Unemotional

Buying a home is a business transaction, and treating it that way helps you save money. Consider any movement by the sellers, however slight, a sign of interest, and keep negotiating.

Each time you make a concession, ask for one in return. If the sellers ask you to boost your price, ask them to contribute to closing costs or pay for a home warranty. If sellers won’t budge, make it clear you’re willing to walk away; they may get nervous and accept your offer.

6. Don't Let Competition Change Your Plan

Great homes and those competitively priced can draw multiple offers in any market. Don’t let competition propel you to go beyond your predetermined price or agree to concessions — such as waiving an inspection — that aren’t in your best interest.

By: G.M. Filisko

Other blog entries

• Doggie Ice Cream Bar: Cones For Bones (05/16/2024)• Dillinger is Gone, Welcome Mosaic Brewing (05/11/2024)

• Grandma Angelina’s Pizzas In Tucson: Barro’s Pizza (05/06/2024)

• Green Acres Estates, Tucson, Arizona (04/16/2024)

• Looking For Relief? Chill Acupuncture And Wellness (04/15/2024)

• Classy Menu, Classy Service: Blue Willow Restaurant (04/09/2024)

• An Antique Dive Bar: The Buffet Bar (03/07/2024)

• Orangewood Estates - A Lovely, Older, NW Tucson Neighborhood (03/05/2024)

• Neighborhood Saloon: Nancy’s Boondocks (03/02/2024)

• Food Court Without The Mall: American Eat Co (02/15/2024)

» Blog archive

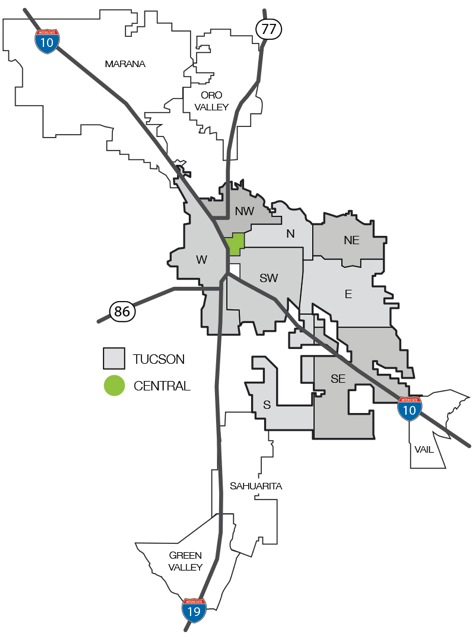

Click on Map to Start Your Tucson Home Search